Establishing a US entity

Navigating Your US Business Journey

Embark on a fruitful business venture in the US with Amplify, your dependable guide for navigating the terrain of limitless possibilities. Are you prepared to explore establishing a US entity? Dive in as we unravel strategies for launching your business in the USA

Your Ally in Establishing a US Entity

Amplify stands firmly beside entrepreneurs and companies aspiring to weave their success stories in the US. We dedicate ourselves to empowering your business, assuring you step into a realm of opportunities with confidence and compliance. What does it mean to successfully create a US entity?

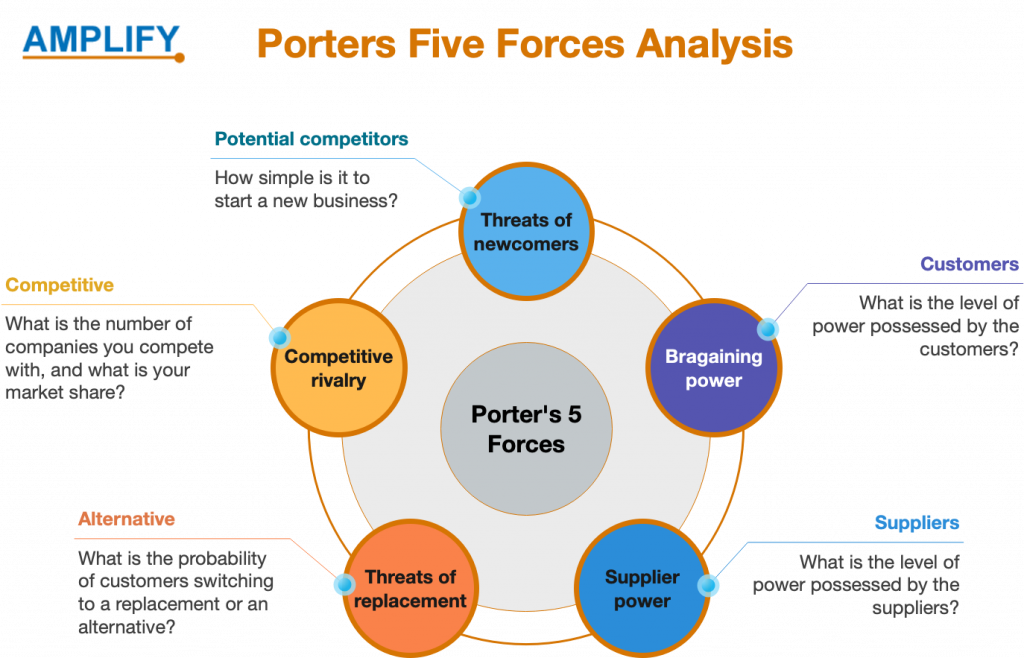

Unlocking Opportunities in the US Market

Your path to establishing a US entity comes with its unique set of challenges and opportunities. We envelop you with the latest information, practical advice, and a treasury of resources, aligning your strategies with the dynamic US market. Can your business find its strong footing and thrive amidst the myriad of possibilities?

Comprehensive Guidance Through Every Step

From legal and regulatory dimensions to financial, market-entry, and operational facets, we mirror your aspirations with our robust understanding. Amplify ensures that your venture into establishing a US entity not only complies with the regulations but also strategically aligns with the multifaceted US market dynamics. How can our profound knowledge of the American market navigate your business toward success?

Nurturing Your US Business with Amplify

Embark on your US entrepreneurial journey with Amplify, a staunch ally in ensuring that the complexities of procedures and compliances become a seamless journey. Together, let’s carve out your success story in the US, solidifying your business presence and nurturing its growth. How does Amplify transform the complex into the achievable in your venture?

Where Your US Entity and Success Intersect

Step into a future where your US entity blossoms into a symbol of success and sustainability. With Amplify, navigate through the intricate process of establishing a US entity, ensuring that every step you take is rooted in compliance, knowledge, and strategic alignment with the vast opportunities the US market unfurls. Are you ready to script your American success story with us?

Visas

The E-1 Treaty Trader Visa enables qualified foreign nationals to work in the U.S., emphasizing significant international trade. This visa is for citizens of countries with U.S. trade or investment treaties.

Applicants must engage actively in trading goods, services, or technology between the U.S. and their home country. They also need to be nationals of a treaty country and sustain ongoing, substantial U.S. trade.

The trade should have considerable quantity, volume, or value. Over 50% of an applicant’s global trade must include the U.S. and their treaty country. Applicants must also demonstrate a purpose to conduct major U.S. trade as principal traders or vital employees.

The role of the employee must be executive, supervisory, or essential. Their skills should be indispensable for the company’s trading efficiency.

The E-1 visa grants initial U.S. entry for up to two years to the trader and dependents. Extensions are possible if you continue to meet the criteria.

Although a nonimmigrant visa, the E-1 category permits indefinite renewals. This is contingent on maintaining substantial U.S. trade activities.

The E-2 Treaty Investor Visa is a type of nonimmigrant visa that allows individuals from certain countries to enter and work in the United States based on a substantial investment in a U.S. business. This visa is specifically designed for entrepreneurs who are citizens of countries that have a treaty of commerce and navigation with the United States.

To qualify for an E-2 visa, the applicant must meet several requirements. Firstly, they must be national of a treaty country. Secondly, they must have made a substantial investment or be in the process of making a substantial investment in a U.S. enterprise. The investment must be sufficient to ensure the successful operation of the business and should not be a marginal one. The exact amount considered substantial can vary depending on the nature of the business.

Furthermore, the E-2 visa applicant must demonstrate that they will develop and direct the enterprise actively. They must also show that their investment funds are lawfully obtained and committed to the business venture. The business itself must be a real and active commercial or entrepreneurial undertaking that produces goods or services for profit.

Once approved, the E-2 visa allows the entrepreneur and their dependents to enter and remain in the United States for the purpose of managing and developing the investment enterprise. The initial period of stay granted under the E-2 visa is typically up to five years, with the possibility of renewals if the qualifying criteria are met.

It’s important to note that the E-2 visa is a nonimmigrant visa, which means it does not directly lead to permanent residency or a green card. However, E-2 visa holders can maintain their visa status indefinitely as long as they continue to meet the requirements and actively operate their qualifying investment enterprise.

The United States government instituted the EB-5 Immigrant Investor Program, often termed the EB-5 Job Creation Visa. This program encourages foreign nationals to make substantial investments in new commercial endeavors in the U.S., with the objective of promoting employment for U.S. workers. In return for their investment, these foreign nationals can obtain permanent residency, commonly referred to as a green card.

Requirement for a New Commercial Enterprise: An investor must invest in a new commercial enterprise. The investor should establish this enterprise as a for-profit business entity after November 29, 1990. If the investor established it on or before this date, they must restructure or reorganize it to qualify it as a new commercial enterprise

After the two-year conditional period, the investor can apply for the removal of the conditions on their permanent residency. They must provide evidence that they have met all the EB-5 program requirements, including job creation. If successful, the investor and their family will be granted permanent residency in the United States.

One must recognize that the EB-5 program operates under specific limitations and regulations, making its application process intricate. Consequently, many investors engage immigration attorneys or consultancies proficient in the EB-5 program to guide them through the procedure effectively

The L-1 visa is a non-immigrant visa category that allows multinational companies to transfer certain employees from their foreign offices to their U.S.-based offices. It temporarily facilitates the transfer of key personnel, executives, and specialized knowledge employees to work in the United States.

The L-1 visa has two subcategories:

- L-1A Visa: This category is for executives and managers within the company. To qualify, the employee must have been working in a managerial or executive role for at least one continuous year within the three years preceding the application. The L-1A visa initially grants a maximum stay of three years in the United States, with the possibility of extending it up to a total of seven years.

- L-1B Visa: This category is for employees with specialized knowledge. Specialized knowledge refers to proprietary knowledge of the company’s products, services, research, equipment, techniques, or processes. The employee must have worked in this specialized role for at least one continuous year within the three years preceding the application. The L-1B visa initially grants a maximum stay of three years, with the possibility of extending it up to five years.

To qualify for an L-1 visa, the following requirements must be met:

- Qualifying Relationship: The U.S. and foreign companies must have a qualifying relationship, which means the U.S. office must be a parent company, branch, subsidiary, or affiliate of the foreign company. Both companies must be actively conducting business.

- Employment with the Foreign Company: The employee must have been employed with the foreign company for at least one continuous year within the past three years.

- Position and Job Duties: The employee must be transferred to the United States to work in an executive, managerial, or specialized knowledge capacity.

- Intent to Return: The employee must intend to return to the foreign company after completing the temporary assignment in the United States.

The L-1 visa offers several benefits, including:

- Dual Intent: L-1 visa holders can maintain dual intent, meaning they can pursue a permanent residency (a green card) while on the L-1 visa without jeopardizing their non-immigrant status.

- Spouse and Dependents: L-1 visa holders’ spouses and unmarried children under 21 years old are eligible for L-2 visas, allowing them to accompany the primary visa holder to the United States. Spouses can also apply for employment authorization to work in the U.S.

- Extensions and Permanent Residency: L-1 visa holders can request extensions to their stay in the United States. The L-1 visa can also serve as a stepping stone for permanent residency through employment-based immigration avenues.

It’s important to note that the L-1 visa application process can be complex, and specific documentation is required to demonstrate the qualifying relationship, employee qualifications, and job duties.