Jeremy Tole serves on the advisory board at Amplify Now Global. As VP of Innovation and R&D at Azbil Corporation, Jeremy spearheads Research and Development, Product Line Management, and Open Innovation. His expertise has significantly impacted global corporations, particularly those with revenues exceeding $2B in areas such as Industrial Automation, Semiconductors, Wireless, Computer Hardware, and Electrical/Electronic Manufacturing. Jeremy holds a Bachelor of Science in Electrical Engineering from the University of Virginia. He is an esteemed member of the Trigon Engineering Society and IEEE, and serves as the vice president of the Wireless Communications Alliance.

Albert Hoogeveen is an expert in international business development, having gained extensive experience at prominent Dutch firms such as Ahold and ING Bank. From 1987 to 2021, he served as a director at Development Agency East Netherlands (Oost NL), where he built a robust network and generated business growth through multiple partnerships. As a specialist in R&D matchmaking, he combines his entrepreneurial skills with market intelligence.

As co-founder and former chairman of HollandBusinessHouse, Albert simplified global expansion for various enterprises. He also contributed as an Advisory Board member of the Business & Science Park Association in Enschede, The Netherlands. Albert’s educational foundation includes an MBA from the University of Hertfordshire and an undergraduate degree from Windesheim University.

In 2022, Albert pivoted his focus toward working with startups and scale-ups through his new firm, XtraBrains. He also serves on the advisory board of Amplify Now Global, a platform for companies seeking to globalize their business.

Bio Frans Meuwissen

Frans Meuwissen is a business development executive with over 25 years of experience driving revenue and business growth globally. He has a proven track record of enhancing existing processes through extensive business, marketing, and sales strategy knowledge. He is highly skilled at establishing strong connections with clients, resulting in successful client acquisition and retention across various organizations.

Frans is also an exceptional leader with a talent for creating relationships with stakeholders and teams to achieve measurable business development in fiercely competitive markets. He is acknowledged for his ability to devise effective business strategies and proficiency in business process optimization, client relations, and product management

Bio Frans Meuwissen

Frans Meuwissen is a business development executive with over 25 years of experience driving revenue and business growth globally. He has a proven track record of enhancing existing processes through extensive business, marketing, and sales strategy knowledge. He is highly skilled at establishing strong connections with clients, resulting in successful client acquisition and retention across various organizations.

Frans is also an exceptional leader with a talent for creating relationships with stakeholders and teams to achieve measurable business development in fiercely competitive markets. He is acknowledged for his ability to devise effective business strategies and proficiency in business process optimization, client relations, and product management.

Amplify is thrilled to present a cutting-edge program designed exclusively for forward-thinking investors. With a proven track record of success, our program is built on innovation, expertise, and unwavering dedication to achieving outstanding returns. Whether you’re a seasoned investor seeking to diversify your portfolio or an enthusiastic newcomer eager to explore the world of finance, the Amplify platform is a gateway to a world of possibilities.

Please fill in the form, and we will send you information about the Amplify Investor Program.

Join the exclusive Amplify Program, designed specifically for companies like yours, with tailored solutions for your industry and business model. Our program is crafted to address the unique challenges scale-up companies face in their global expansion journey.

With Amplify, you’ll gain access to unparalleled support and expertise. Our collaborative approach ensures you receive a customized plan, carefully crafted to meet your needs. Our team of experienced professionals will guide you every step of the way, providing mentorship, connecting you with industry experts, and offering invaluable market entry guidance.

But that’s not all. Our program goes beyond mere support; it’s a strategic partnership. We’re dedicated to helping you achieve your objectives and take your business to the next level. With our proven track record, we provide the tools, resources, and strategic support necessary to accelerate your growth and propel your success.

Take advantage of this opportunity to amplify your business. Join the Amplify Program today and unlock the doors to global expansion. It’s time to reach new markets, surpass your competition, and realize your full potential.

U.S. prospects have long attracted international entrepreneurs and inventors. A dynamic startup ecosystem, finance, and broad market await international entrepreneurs in the U.S. However, the U.S. immigration system is complex, so overseas entrepreneurs must grasp their visa choices before moving. We explain some of these visas’ requirements, benefits, and downsides for ambitious entrepreneurs in the world’s most outstanding economy. Understanding visa choices can help international entrepreneurs succeed in America.

See some info on the USCIS Site: Options for Noncitizen Entrepreneurs to Work in the United States.

The E-1 Treaty Trader Visa enables qualified foreign nationals to work in the U.S., emphasizing significant international trade. This visa is for citizens of countries with U.S. trade or investment treaties.

Applicants must engage actively in trading goods, services, or technology between the U.S. and their home country. They also need to be nationals of a treaty country and sustain ongoing, substantial U.S. trade.

The trade should have considerable quantity, volume, or value. Over 50% of an applicant’s global trade must include the U.S. and their treaty country. Applicants must also demonstrate a purpose to conduct major U.S. trade as principal traders or vital employees.

The role of the employee must be executive, supervisory, or essential. Their skills should be indispensable for the company’s trading efficiency.

The E-1 visa grants initial U.S. entry for up to two years to the trader and dependents. Extensions are possible if you continue to meet the criteria.

Although a nonimmigrant visa, the E-1 category permits indefinite renewals. This is contingent on maintaining substantial U.S. trade activities.

The E-2 Treaty Investor Visa is a type of nonimmigrant visa that allows individuals from certain countries to enter and work in the United States based on a substantial investment in a U.S. business. This visa is specifically designed for entrepreneurs who are citizens of countries that have a treaty of commerce and navigation with the United States.

To qualify for an E-2 visa, the applicant must meet several requirements. Firstly, they must be national of a treaty country. Secondly, they must have made a substantial investment or be in the process of making a substantial investment in a U.S. enterprise. The investment must be sufficient to ensure the successful operation of the business and should not be a marginal one. The exact amount considered substantial can vary depending on the nature of the business.

Furthermore, the E-2 visa applicant must demonstrate that they will develop and direct the enterprise actively. They must also show that their investment funds are lawfully obtained and committed to the business venture. The business itself must be a real and active commercial or entrepreneurial undertaking that produces goods or services for profit.

Once approved, the E-2 visa allows the entrepreneur and their dependents to enter and remain in the United States for the purpose of managing and developing the investment enterprise. The initial period of stay granted under the E-2 visa is typically up to five years, with the possibility of renewals if the qualifying criteria are met.

It’s important to note that the E-2 visa is a nonimmigrant visa, which means it does not directly lead to permanent residency or a green card. However, E-2 visa holders can maintain their visa status indefinitely as long as they continue to meet the requirements and actively operate their qualifying investment enterprise.

The United States government instituted the EB-5 Immigrant Investor Program, often termed the EB-5 Job Creation Visa. This program encourages foreign nationals to make substantial investments in new commercial endeavors in the U.S., with the objective of promoting employment for U.S. workers. In return for their investment, these foreign nationals can obtain permanent residency, commonly referred to as a green card.

Requirement for a New Commercial Enterprise: An investor must invest in a new commercial enterprise. The investor should establish this enterprise as a for-profit business entity after November 29, 1990. If the investor established it on or before this date, they must restructure or reorganize it to qualify it as a new commercial enterprise

After the two-year conditional period, the investor can apply for the removal of the conditions on their permanent residency. They must provide evidence that they have met all the EB-5 program requirements, including job creation. If successful, the investor and their family will be granted permanent residency in the United States.

One must recognize that the EB-5 program operates under specific limitations and regulations, making its application process intricate. Consequently, many investors engage immigration attorneys or consultancies proficient in the EB-5 program to guide them through the procedure effectively

The H-1B visa lets U.S. employers temporarily hire foreign workers for specialized roles. This visa addresses the shortage of skilled professionals in areas like engineering, IT, and finance. To be eligible, the job offered must demand a bachelor’s degree in a specific field. The U.S. employer must sponsor the foreign worker and show a genuine need for their expertise. Moreover, the worker should have a relevant bachelor’s degree or work experience equivalence. Employers also need an approved Labor Condition Application from the Department of Labor.

The visa has a set limit each year. Currently, there are 65,000 visas, with an additional 20,000 for those holding U.S. advanced degrees. If applications exceed this cap, a lottery determines which ones get processed. H-1B visa holders can stay in the U.S. for three years and can extend it to six years. Some even stay longer if they meet certain conditions, such as initiating the green card process. They can bring their spouse and children under 21 on the H-4 dependent visa. H-4 holders can study, but there are limitations on working. Finally, H-1B visa holders can pursue a green card without jeopardizing their current status.

Here are some key points about the H-1B visa:

To qualify for an H-1B visa, an individual must satisfy specific criteria. The U.S. employer must offer a position in fields such as engineering, IT, finance, or medicine that requires at least a bachelor’s degree or its equivalent in a particular field. Additionally, the employer has to submit an H-1B petition for the foreign worker and demonstrate a genuine need for the worker’s specialized skills and knowledge. Foreign workers should have at least a bachelor’s degree or its equivalent in a related field, but in some instances, relevant work experience can stand in for formal education. Furthermore, the employer must secure a Labor Condition Application (LCA) approval from the U.S. Department of Labor to ensure the foreign worker’s salary meets industry standards and their employment won’t negatively affect similarly positioned U.S. workers.

The H-1B visa carries an annual limit, capping the visas issued each fiscal year. Right now, they set the regular cap at 65,000 visas, and they reserve an extra 20,000 visas for those with advanced degrees from U.S. universities. If H-1B petitions surpass this cap, a lottery system picks the petitions for processing randomly.

H-1B visa holders can stay in the United States for three years initially. They can extend this duration to a maximum of six years. In specific circumstances, like when the foreign worker starts a green card application, they might qualify for exceptions and extensions beyond the six-year mark.

H-1B visa holders can bring their spouses and unmarried children under 21 to the U.S. on H-4 dependent visas. H-4 visa holders are allowed to study in the U.S. but generally cannot work, although there are certain exceptions.

H-1B visa holders can maintain dual intent, meaning they can pursue permanent residency (a green card) while on the H-1B visa without jeopardizing their non-immigrant status.

The H-1B visa program is subject to various regulations and requirements, and the application process can be complex. Employers are required to comply with specific labor and immigration laws.

The L-1 visa is a non-immigrant visa category that allows multinational companies to transfer certain employees from their foreign offices to their U.S.-based offices. It temporarily facilitates the transfer of key personnel, executives, and specialized knowledge employees to work in the United States.

It’s important to note that the L-1 visa application process can be complex, and specific documentation is required to demonstrate the qualifying relationship, employee qualifications, and job duties.

Amplify is your ultimate partner in navigating the global market. We specialize in guiding and supporting companies venturing into new territories, helping them establish a strong foundation for success.

Our expertise lies in working closely with small to midsize businesses that have their sights set on entering the lucrative U.S. or European markets. With Amplify by your side, you’ll receive tailored guidance and strategic assistance to make your entry and growth seamless. Let us empower your expansion plans and set you on the path to triumph in the global marketplace.

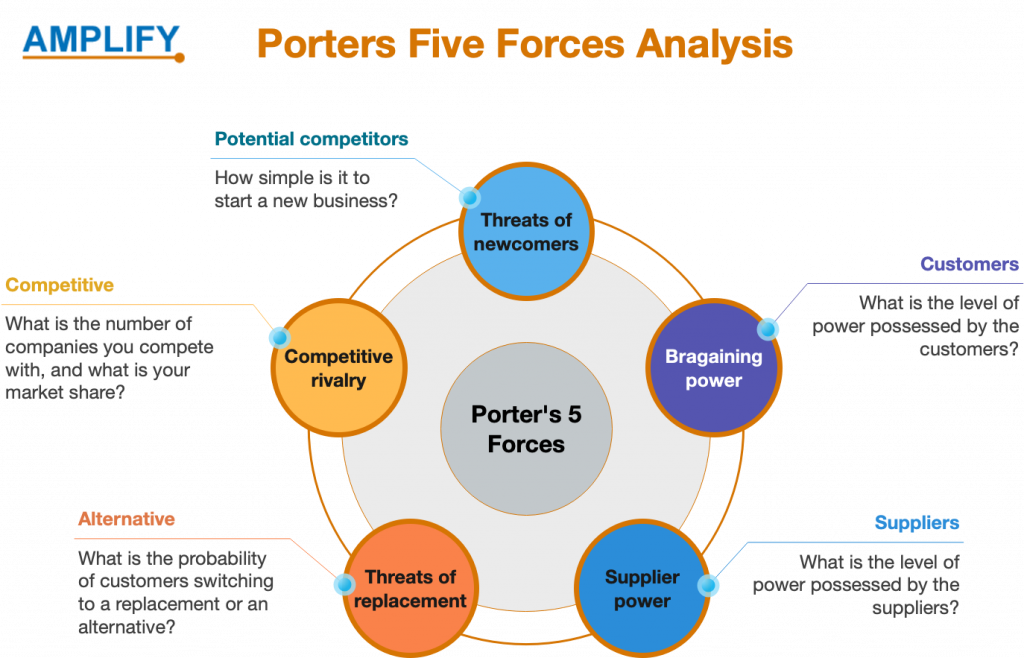

Comprehend the competitive landscape and its impact on business success. Porter’s Five Forces analyze industry attractiveness and strategic positioning, especially for start-ups. Determine competitiveness and profitability by considering the competition, new entrants, substitutes, and consumer and supplier power. Variables like differentiation, innovation, capital needs, regulations, customer preferences, and substitutes influence these forces. Apply Porter’s model across sectors to assess the competition and enhance long-term profitability. Named after Michael E. Porter, Harvard Business School professor.

To effectively use Porter’s Five Forces framework to look over your market, please follow the steps below. Start by defining your industry and target market to understand your offerings, value proposition, and target customers. Next, identify the relevant forces and their underlying drivers. It is essential to assess each party’s intensity, which can be accomplished using a scale ranging from low to high or assigning a score based on your analysis. Creating a five-forces diagram can help synthesize your findings.

Once you have assessed the forces, the final step is to interpret the results and formulate a strategy. Utilize the outcomes to identify opportunities, threats, strengths, and vulnerabilities. Then, develop strategic options and actions to enhance your competitive advantage and create customer value. This step is critical, as it ensures that your business is well-positioned to compete effectively in the market.

Porter’s five forces framework provides several advantages, such as a comprehensive analysis of the industry’s competitive landscape, strategic insights into the company’s market positioning, the ability to predict changes in the industry environment, and the identification of opportunities for establishing a sustainable competitive advantage.

However, the framework has limitations, such as a limited scope that concentrates solely on external factors and disregards internal factors that can impact a company’s performance. It insinuates a static industry structure, ignores the possibility of collaboration between companies within an industry, and relies on a defined industry, which can be challenging to determine for some businesses.

The framework should be used with other strategic frameworks and tools to obtain a more comprehensive understanding of a company’s competitive landscape.

Business Process Improvement (BPI) offers organizations a systematic approach to drive efficiency, effectiveness, and overall business performance. To harness the full potential of BPI, measuring and evaluating its impact on business outcomes and goals is crucial. Organizations can ensure the desired results and maximize the benefits of BPI initiatives by employing clear objectives, relevant metrics, baseline measurements, a holistic measurement approach, technology utilization, continuous monitoring, and stakeholder feedback. Embracing a culture of evaluation allows businesses to adapt, improve, and thrive in an ever-evolving marketplace.

Define objectives that align with organizational goals and strategic direction. Select critical performance, customer satisfaction, quality, and innovation indicators that align with your goals. Establishing baseline measurements before implementing BPI can serve as a benchmark for evaluating progress and understanding the impact of process improvements. Combine both quantitative and qualitative factors to gain a comprehensive understanding of the impact. Quantitative data provides numerical insights, while qualitative data captures the human aspect and contextual awareness

Data is Key:

Data is crucial for evaluating BPI effectiveness. Use charts, graphs, dashboards, and statistical techniques to analyze data, identifying trends and patterns. Gather data from surveys, interviews, observations, and systems for a comprehensive understanding. Compare against baselines, targets, benchmarks, and best practices to evaluate BPI progress.

Create a data management plan to inform stakeholders about collected metrics. Include metric sources, names, denominators, numerators, sample size, and exclusion criteria. Ensure shared understanding and effective data collection through collaborative meetings and training with responsible parties.

Continuous evaluation of BPI is crucial. Regularly review, refine, and adapt based on results, feedback, and evolving organizational needs. Keep BPI relevant and effective in addressing goals and challenges.

Furthermore, monitoring the external environment, including market trends, customer preferences, and competitor actions, is crucial. This external awareness helps to ensure that your BPI aligns with the changing landscape and remains adaptable to dynamic circumstances. By consistently evaluating and updating your BPI, you can ensure that it continues to deliver lasting value and benefits to your organization, keeping you ahead of the curve and driving sustained success.

The Balanced Scorecard monitors BPI across financial, customer, internal processes, and learning perspectives. Assess impact comprehensively and address gaps using this approach. Learn how it helps strike balance and make informed BPI adjustments

Evaluate BPI holistically, considering financial, customer, internal processes, and learning perspectives. Use the balanced scorecard to track impact on multiple facets simultaneously, ensuring comprehensive outcomes. E.g., cost reduction and productivity gains may impact customer satisfaction or employee engagement..

Using balanced scorecard evaluation, businesses gain insights for data-driven adjustments in BPI strategies, aligning initiatives with desired outcomes across all perspectives.

Communication and reporting play crucial roles in ensuring the success and sustainability of BPI initiatives. It is essential to effectively communicate and report the results to various stakeholders, including managers, employees, customers, and partners. This communication informs them about the achievements, challenges, and lessons learned from the BPI efforts. Furthermore, leveraging the results allows for acknowledging successes, recognizing the team’s contributions, and motivating staff members.

In addition to celebrating wins, utilizing the results to provide feedback to all stakeholders is essential. This feedback can help identify opportunities for further improvement and guide the planning of future steps in the BPI journey. Organizations can foster a culture of continuous improvement and drive sustainable BPI outcomes by effectively communicating the results and leveraging them for input and planning

Because of the rapid increase in the world’s population, the demand for food is anticipated to increase by 70 % by the year 2050. Despite this, the hunger problem still affects around 9.9% of the world’s population. Innovative agricultural technology is required to address this challenge successfully. Thankfully, there are encouraging indications that things are getting better. Learn about the farming innovations to keep an eye out for in 2023 that can transform how farmers cultivate, transport, store, and manage their produce.

Tech 1: Bee Vectoring Technologies

Honey bees produce $20 billion in U.S. crops. Bees are vital to human survival. Thus agriculture technology is evolving to preserve and maximize pollination. Bee Vectoring Technologies pollinates crops with commercially raised bees instead of insecticides. It doesn’t require watering or tractors. Instead, the scientifically built bumblebee hive lets bees take up a trace of pest control powders on their legs to disseminate around the land. This agriculture technology improves soil quality, crop productivity, and sustainability. Bee Vectoring Technologies’ method works for blueberries, sunflowers, apples, and tomatoes on farms of all sizes.

Tech 2: Precision Agriculture

Precision agriculture collects, processes, and analyzes data to improve soil quality and productivity. Precision agricultural data helps managers enhance farms and products in numerous crucial areas, including resource usage efficiency, Sustainability, Profitability, Productivity, and Quality. Big data helps farmers optimize crop productivity by controlling moisture, soil, and microclimates. Remote sensing, drones, robotics, and automation increase crop health and maximize agricultural resources, increasing productivity. Research firms expect the precision farming market to reach $16.35 billion by 2028, growing 13.1% CAGR. The organization expects market expansion through government backing and crop health monitoring efficiency.

Tech 3: laser Scarecrows

Birds, mice, and rats can ruin open-field crops. Traditional scarecrows protected farms from ravenous attackers. Today, farmers use motion-sensor devices to discourage birds from stealing crops. A University of Rhode Island researcher designed a green laser scarecrow after noticing that birds are sensitive to green. Under sunshine, the light can scare birds and harm crops 600 feet away. Early laser scarecrow testing showed that they could reduce bird populations near farms by 70% to 90%, decreasing crop damage.

One of our era’s most promising business opportunities is the development of a circular economy. By adopting this approach, we can bolster local economies in a manner that benefits all members of society while generating significantly more jobs than the conventional linear waste management model. Furthermore, the circular economy can create even more employment opportunities by promoting repair and rental services. The adoption of circularity also offers a viable means of achieving net-zero emissions while promoting environmental sustainability by aligning our economic practices with our planet’s finite resources.

Some of the most exciting possibilities for a circular economy are in the construction sector. Construction offers exciting circular economy opportunities. Innovative design and widespread construction material recycling might cut building CO2 emissions by 30%. Recycling, repair, digital, and innovation-driven occupations will result from a circular economy. Our circular building model is based on “reduce, reuse, recycle” at Holcim. We are constantly developing green building solutions like ECOPact green concrete, which emits 30% to 100% less carbon than average (CEM 1) concrete. ECOPact+ concrete uses repurposed building and demolition materials when permitted.

If the world is going to get to net zero carbon emissions, it will happen first in cities. The United Nations says that more than 60% of the world’s greenhouse gas emissions come from cities. However, cities are also laboratories and essential players in the fight against climate change. With countless instances appearing worldwide, we urgently need to understand what the most inventive circular cities worldwide are doing to speed up the transition.